When US Airways management took over American Airlines 11 years ago, they had a conundrum in New York. New York is a competitive market, and they’d generally shied away from direct competition while running US Airways. And they weren’t big enough in New York to be the biggest competitor, either.

So they came up with a strategy of not competing for New York business but instead wanted to become the airline that brought people to New York. They timed their flights, often from smaller cities, to let people travel to New York and back in a day or at least fly up in the morning and leave after the business day.

That strategy didn’t make them money flying, so they pulled down their New York operation. They stopped serving as many destinations. By 2018 they flew to hubs, they served LA (which gave them an advantage pitching corporate contracts there after United pulled out of JFK), and they served London Heathrow where joint venture partner British Airways is based. They had a few other destinations that amounted to what the airline described as a ’boutique operation’.

Then they squatted on slots with inexpensive short distance regional flights, and took advantage of slot waivers wherever they could such as reducing their flying while New York JFK did runway work. They actually lost track of some slots, failed to use them, and had them taken away.

The ’boutique airline’ pitch wasn’t a great strategy either. They weren’t poised to win New York corporate business with a smaller operation. They weren’t poised to attract New York loyalty. And perhaps worst of all, a smaller New York footprint meant ceding the credit card market in one of the most important financial centers in the world. They just didn’t have the relevance to the New York customer.

During the pandemic they came out with a brand new strategy and it seemed brilliant: they would tie up with JetBlue. Together they were the number 3 and 4 carriers in the New York market and would be big enough to compete with Delta (and United at Newark). Far from being anti-competitive, this created a third real competitor in greater New York.

To get signoff from the Department of Transportation, they agreed to give up some slots, and to give up more if they didn’t grow the number of seats offered out of New York (more supply and likely lower prices, the opposite of anti-competitive behavior). The federal government approved the deal – and then set out to sue to overturn it – all within a matter of months and with no new information just a change in administration.

The Department of Justice won its antitrust case at the district court level. An appeals court didn’t find clear reversible error. JetBlue had already moved on to focus on its ill-fated attempt to acquire Spirit, and now to do a deal with United (that has far bigger market concentration issues than the American-JetBlue Northeast Alliance but there’s a new administration).

So what is American Airlines to do?

- They remain undersized in New York and can’t really grow because the airports are slot-controlled.

- They were losing money on New York flights. Vasu Raja claimed to me years ago that cutting back on flying stopped the losses, but I argued years they were doing the accounting wrong – they needed to include co-brand credit card revenue into the equation because an aggressive New York presence was how’d they’d be relevant to the market and attract card acquisition and spend.

- Raja actually adopted this mantra when he became responsible not just for the network but for revenue. He’s no longer at the airline, but the problem remains: what path forward?

Obviously they should optimize their schedules – stop burning peak-hour slots on thin-regional routes and upgauge high yield routes. They should continue to lean into the co-location of their oneworld partners in terminal 8. They should consider growing at Newark (long-term, this month wouldn’t be the time to announce it).

But I actually think there are several additional things that American Airlines can do to compete effectively in New York.

- “We are the second largest global carrier in New York” Newark is not New York and JetBlue isn’t global. “As #2, We Try Harder.” This really did work for Avis for a long time.

- “We serve the largest, most important markets from New York so we’ve got you covered.” They fly from New York LaGuardia to Chicago; Atlanta; Dallas; Orlando; Miami; Fort Lauderdale; Charlotte; Detroit; West Palm Beach; Nashville; Boston; Tampa; Raleigh; DC; St. Louis; New Orleans; Columbus; Pittsburgh; Cleveland; Indianapolis; Fort Myers; Charleston, S.C.; Myrtle Beach; Memphis; Greensboro; Richmond; Buffalo; Greenville; Wilmington, N.C.; Oklahoma City; Norfolk; Grand Rapids; Northwest Arkansas; Asheville; Charlottesville; Des Moines; Columbia; Litte Rock; Portland, M.E.; Tulsa; Madison; Burlington; and Nantucket.

- “We upgrade our best customers more often than competitors.” Only about 13% of first class passengers on Delta are there on elite upgrades. Delta really doesn’t offer upgrades anymore. American upsells aggressively coach passengers for paid buy ups, too, but they’re still behind Delta on this. They should market that.

- “Our miles are worth more.” Every independent observer agrees with this. The latest was the IdeaWorks study. AAdvantage won three Freddie Awards. Delta’s own Vice President for SkyMiles says they aren’t trying to compete on value to the consumer.

- Focus on the product. This may sound odd talking about American Airlines, but Delta flies its worst business class product on premium transcons. Their 767s shouldn’t be branded ‘Delta One’ at all. American still has Flagship First Class (such as it is) and will be bringing on A321XLRs with suites that offer doors in business class to replace their current premium cross-country planes. And while their New York JFK lounge offering doesn’t top Delta’s business class lounge there, they make their lounge products available to far more customers.

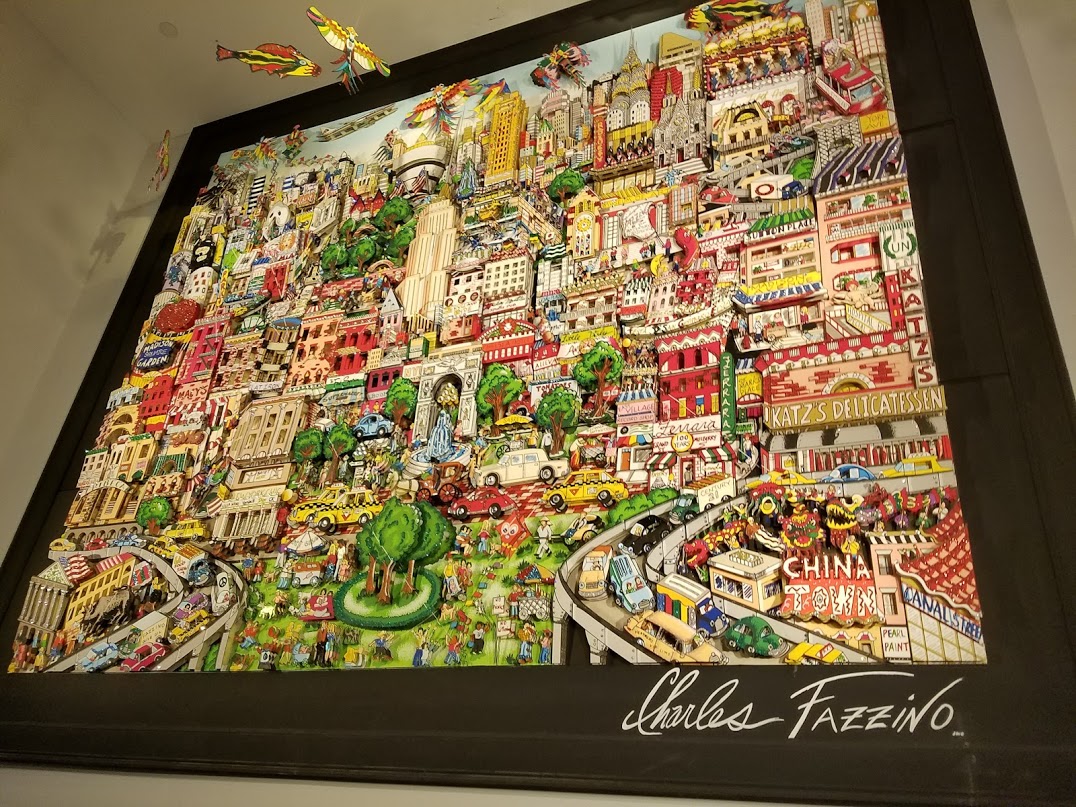

- Focus on small New York-focused changes to the product. Swap Dr. Pepper for Dr. Brown’s on New York flights. Load chocolate syrup in the coach galleys and offer egg creams. The airline needs to build out its buy onboard offerings, so start with New York and do bagels and lox on morning departures and pastrami sandwiches later in the day. Partner with local brands on meals – maybe Katz Deli or Nathan’s Hot Dogs and offer this on a pre-order basis in first class.

- Run promos like crazy. Get aggressive. Pair this with messaging about the relative value of the AAdvantage program. Name and shame, and print some miles. Run 100,000 mile card offers strictly targeted at the New York market.

- Acquire more slots opportunistically. They will never replace the treasure trove of slots that US Airways management gave away to Delta but slots controls at New York airports aren’t going away any time soon, and there’s no use waiting for slots to be marketed ‘openly’. Aggressively call every foreign carrier that has some. See what you can beg, borrow or steal from partners. Expand wherever you can.

But maybe first and foremost… acquire JetBlue. No United deal has been announced yet! And it’s not clear it’ll be a merger (yet) anyway.

United is certainly in a better financial position to do the acquisition. But American is still stronger than JetBlue is – their market cap is low enough American could possibly pull it off.

And while an antitrust case ruled against their partnership that was because they were separate companies that were ‘carving up a market’. The same logic would not have applied to a single company. See broadly Copperweld v. Independence Tube Corp. (1984) where a single company, or subsidiary and parent company, cannot be considered to ‘collude’ until the Sherman Act.

Besides, (1) American-JetBlue is less of an antitrust issue than United-JetBlue, and (2) the Trump administration approved the Northeast Alliance in the first place, it was the Biden administration that reversed that position.