George W. Bush used to talk about the soft bigotry of low expectations. All I could think when American Airlines CEO went into his carrier’s fourth quarter earnings call oddly triumphant is that former Texas Governor Bush must have had the Texas-based airline in mind.

- They boast about ‘record revenue’ which would be almost impossible not to see after 20% inflation since the pandemic.

- They earned $590 million for the quarter, which isn’t losing money, but it’s only half of what their major competitors United and Delta earned.

Former CEO Doug Parker declared in September 2017 that the airline would ‘never lose money again’. At the time he laid out an expectation that the carrier would always earn $3 billion to $7 billion annually. Adjusted for inflation that’s now $3.5 billion to $8.5 billion. Yet for the full year they did not earn even $1 billion. Against $54.2 billion in revenue, $846 million is a paltry 1.6%.

Falling short several billion dollars in profits, they touted success in cutting costs $100 million more than they’d planned. That’s called re-arranging deck chairs.

This is better than losing money. It’s better than Spirit Airlines – which Isom used to say was his north star. But their 2025 forecasts don’t show business improving aggressively. They project losing money in the current quarter.

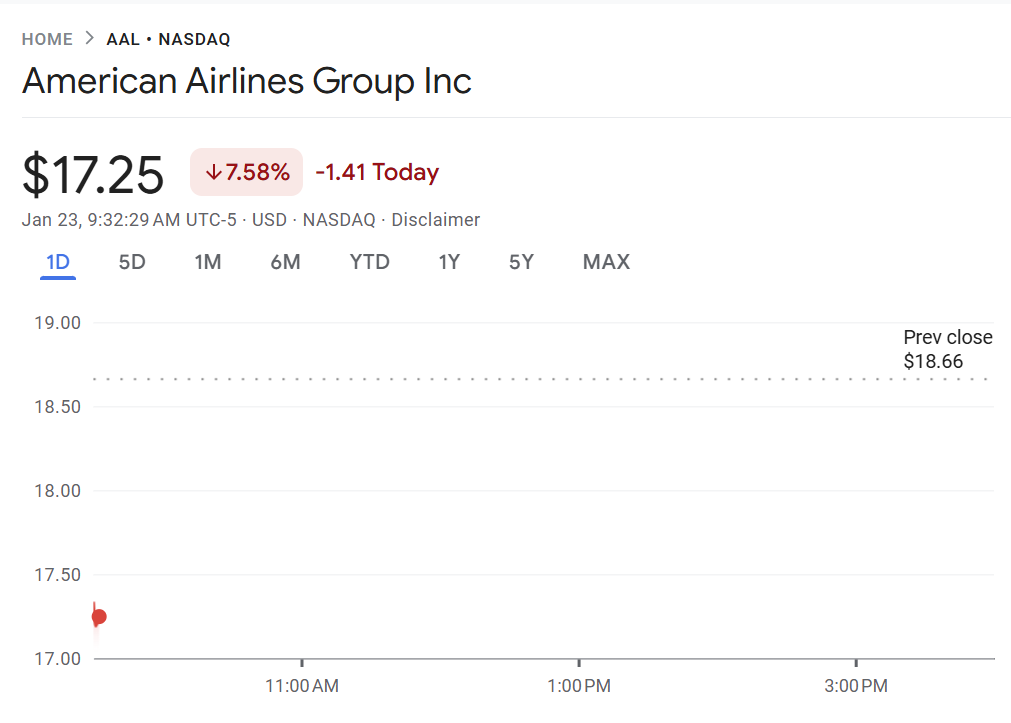

American Airlines stock opened down ~ 7.5%, while United and Delta opened roughly flat.

American Loses Money Flying People In Their Planes

Most of the money American is earning comes from Citibank and Barclays. Operating cost per seat mile was greater than passenger revenue per seat mile in both the fourth quarter and for the full year. Tis means they lose money moving passengers. The profit they earn comes from selling miles to banks.

Yet the numbers aren’t quite as big as they tout. They claim $6.1 million cash from AAdvantage, up 17% year-over-year, but a significant portion of that growth comes from a signing bonus on their new 10-year credit card partnership. That’s non-recurring and will be amortized over the life of the deal.

And even American’s credit card has lost ground – what ultimately matters isn’t just deal terms but how much consumer spending happens on the card. Six years ago, American airlines cards saw more spend than any other airline’s co-brands. At their last investor day they conceded they had dropped to third (so behind Delta and United).

American Airlines Can Compete With The Best In The Industry, But Leadership Needs To Shift Focus

There’s a lot to look forward to from American in 2025 from new business class widebody suites; the arrival of the Airbus A321XLR; Philadelphia Flagship Lounge that should be nicer than the rest of American’s business lounges; more first class seats on Airbus A319 and A320 narrowbodies; and high speed wifi on 2-cabin regional jets.

Credit: American Airlines

Flagship Suite Preferred Seat, Credit: American Airlines

American needs a Chief Commercial Officer and a unified head of AAdvantage, rather than a split team with one group focused on passenger customers and a different team focused on selling points. AAdvantage is the shining star of American Airlines, and a real competitive advantage and yet it’s actually under-marketed (beyond executives repeating the mantra that it’s better).

There isn’t someone doing much of a job of owning the vision and communication to customers about the value they can get out of the program through greater engagement, and driving continued improvement at a senior enough level to make big things happen quickly.

Their new Citi cobrand agreement may be great, but it will be underexploited. Revamp of the premium Executive card made that product worse for consumers, and while the small business card comes with access to their small business program and extra credit for tickets towards earning status, the way card spend interacts with the program has been confusing and the program itself is hugely devalued by about two-thirds.

And they need to stop playing small ball, more interested in ‘not spending a dollar more than they need to’ and investing in the kind of product that customers want to pay a premium for – in other words, doing more than just talking up ‘premium seats’ but delivering on a premium experience. And doing more than giving away the store to managed corporate business to bribe them back after chasing them away.